Credit Opinion

Economic Indicators 2019

Net sales: 772 785 EUR

Profit/loss: 144 156 EUR

Number of employees: 4

Assets: 399 500 EUR

Equity: 326 071 EUR

Conclusion

The company may be credited in the amount of the recommended credit limit. Company’s rating is excellent (AAA) and there is low probability of insolvency.

Economic situation: Earnings decreased last year. The level of earnings is relatively high. Profitability is very good. Amount of equity is

relatively high. Registered capital was increased.

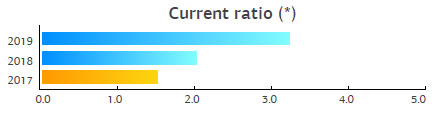

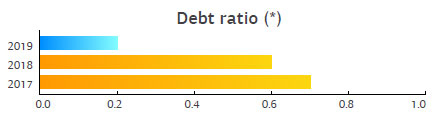

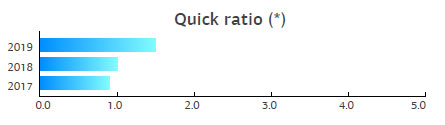

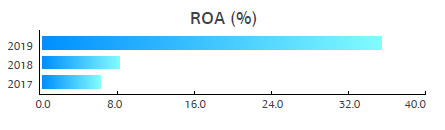

Financial situation: current ratio — very good, quick ratio — very good, cash ratio — very good, collection period — average. Debt ratio is very good, the company is relatively independent of debt capital. Return ratios: profit margin — very good, return on assets — very good.

Credit Rating

Creditinfo Eesti AS recommends a credit valuation to help you decide whether to sell on credit and how much. The credit valuation consists of the following components: credit limit, rating and insolvency probability. The credit limit is the recommended limit amount for selling on credit. The insolvency probability show the likeliness of the risk of the company falling into arrears: if it is less than 5% , the risk is low; the probability between 5 and 12% is considered moderate; and the risk is considered high at 12% or higher. The Creditinfo rating is the consolidated rating of the company’s economic and financial standing of the company and its payment habits. The rating is expressed in letter combinations: AAA stands for excellent; AA, for very good; A, for good; BBB, for satisfactory; BB, for passable; B, for weak; C, for unsatisfactory; and U, O and N are not rated. The illustration to the rating shows the comparative distribution of Estonian companies on the basis of rating classes (see p 1).

Rating: AAA excellent

Probability of insolvency: 0.5%

Credit rating: Credit recommended

Credit limit: 51 519 €

Commercial Register Records

Business name: MasterChem OÜ

Register code: 10755076

Registered: 25/04/2001, Tartu Maakohtu Registriosakond

Address: Lao tn 4

City/county: Maardu linn 74114

Business type: private limited company

Capital: 10 000 EUR

Statutes: 24/11/2017

Financial year: 01.01-31.12

Economic Information

Economic Information

Firm’s sphere of business is determined on the basis of EMTAK 2008. EMTAK (The Estonian Classification of Economic Activities) is the national version of the

international harmonised NACE classification.

20591 Manufacture of other chemical products n.e.c.

4675 Wholesale of chemical products

VAT liability

VAT payer since: 01/05/2001

VAT number: EE100688636

Taxes Paid

The data originates from the Estonian Tax and Customs Board. Taxes paid is displayed as 0 when a) the person hasn’t paid taxes, b) VAT refund exceeds the

paid sum, c) the person belongs to a VAT group, where the representative of the group will submit a VAT return and pay the tax for the VAT group members. An

exporter’s paid tax sum may be smaller than the declared sum in the tax return.

In 2Q 2020, the company paid the Tax and Customs Board 32 563.27 euros as state taxes and 4 401.04 euros as payroll taxes

| Period | Average monthly taxes (EUR) | Average monthly payroll taxes (EUR) |

|---|---|---|

| 2Q 2020 | 10 854.42 | 1 467.01 |

| 1Q 2020 | 4 507.24 | 1 822.89 |

| 4Q 2019 | 7 541.02 | 1 339.48 |

| 3Q 2019 | 4 583.58 | 3 557.40 |

| 2Q 2019 | 3 717.95 | 2 176.01 |

| 1Q 2019 | 8 496.50 | 1 973.45 |

| 4Q 2018 | 5 053.11 | 995.47 |

| 3Q 2018 | 3 864.07 | 1 266.91 |

| 2Q 2018 | 6 117.67 | 1 221.51 |

| 1Q 2018 | 7 815.97 | 1 369.62 |

| 4Q 2017 | 3 235.47 | 1 467.44 |

| 3Q 2017 | 5 767.83 | 1 496.77 |

| 2Q 2017 | 4 643.61 | 1 400.35 |

Revenue Distribution by Activity

Activity’s net sales derive from the latest annual account.

Sphere of business (EMTAK)

| Sphere of business (EMTAK) | Net Sales 2019 | Proportion |

|---|---|---|

| Manufacture of other chemical products n.e.c. (20591) | 192 389 EUR | 24.9 % |

| Wholesale of chemical products (4675) | 580 396 EUR | 75.1 % |

RATIO

Liquidity and solvency

| Working capital (th EUR) | 123.0 | 94.6 | 79.3 |

| Current ratio (*) | 3.2 | 2.0 | 1.5 |

| Quick ratio (*) | 1.5 | 1.0 | 0.9 |

| Cash ratio (*) | 0.8 | 0.1 | 0.0 |

| Collection period (days) | 27 | 46 | 57 |

Capital circulation

| Assets turnover (*) | 1.9 | 1.9 | 1.7 |

Capital strucutre

| Debt ratio (*) | 0.2 | 0.6 | 0.7 |

Efficiency

| Operating margin (%) | 19.1 | 4.7 | 4.1 |

| Profit margin (%) | 18.7 | 4.1 | 3.5 |

| ROA (%) | 35.2 | 8.0 | 6.0 |

| Cash flow (th EUR) | 34.4 | 6.7 | -6.5 |

Credit Register Information

Payment default is the borrower’s failure to comply with its contractual financial obligation for more than 45 days from the day following the due date and when the sum of an arrear together with interests and penalties is at least EUR 30. Information on payment defaults derives from the members or other contractual parties of the Credit Register. The given data includes the default’s appearing and termination dates or the status, the sum’s magnitude and origin. Ranges are distributed as follows: EUR 30.00 — 64.99, EUR 65.00 — 319.99, EUR 320.00 — 639.99, EUR 640.00 — 3 199.99, EUR 3 200.00 — 12 799.99, EUR 12 800.00 — 63 999.99, EUR 64 000.00 and more. Payment default displayed in the register is inputted either by the creditor or by a person acting on creditor’s behalf.